However Preference shares could be converted into equity shares. Redeemable Preference Shares.

Types Of Shares Prezentaciya Onlajn

There are many different types of shares in a private limited company also known as classes of shares and come with different rightsThese include.

. To determine the accounting treatment of preference shares and dividend on such shares first you have to identify if preference shares are redeemable or irredeemable. To explore more. Non-convertible shareholders cannot convert their shares into equity shares.

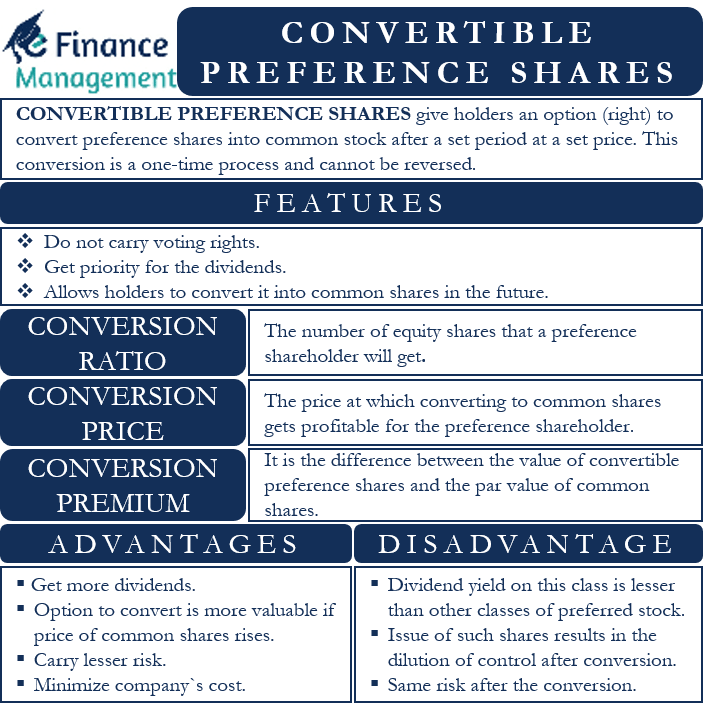

Convertible preferred stock is preferred stock that includes an option for the holder to convert the preferred shares into a fixed number of common shares usually any time after a predetermined. In general equity shares carry the right to vote although preference shares do not carry voting. The holders of convertible preference shares are given an option to convert whole or part of their holding into equity shares after a specific period of time.

The next major difference is the right to vote. A company can repurchase or claim redeemable preference share at a fixed price and time. Ordinary shares are non-convertible to a different class of shares.

Equity shares cannot be converted. ALA-PRATO were yielding above the 45 mark based on its quarterly dividend. Types of shares issued for a private limited company.

Redeemable preference shares are those shares which are redeemed or repaid after the expiry of a stipulated period. So to simplify compliance requirements and have uniform guidelines for various categories of foreign investors like Foreign Institutional Investors FIIs Sub Accounts and Qualified Foreign Investors QFIs merged into a new investor class termed as Foreign Portfolio Investors FPIs. The instruments together bracketed as NCDs include non-convertible debt securities non-convertible redeemable preference shares perpetual non-cumulative preference shares and perpetual debt.

Equity shares are irredeemable but preference shares are redeemable. Convertible bonds are the most common compound financial instruments and IAS 32 uses them as an example to illustrate its. 14 of the Companies Prospectus and Allotment of Securities Rules 2014 -.

This can be done after a certain time period and at a. This will be the case when eg. It is usually the first series of stock after the common stock and common stock options issued to company.

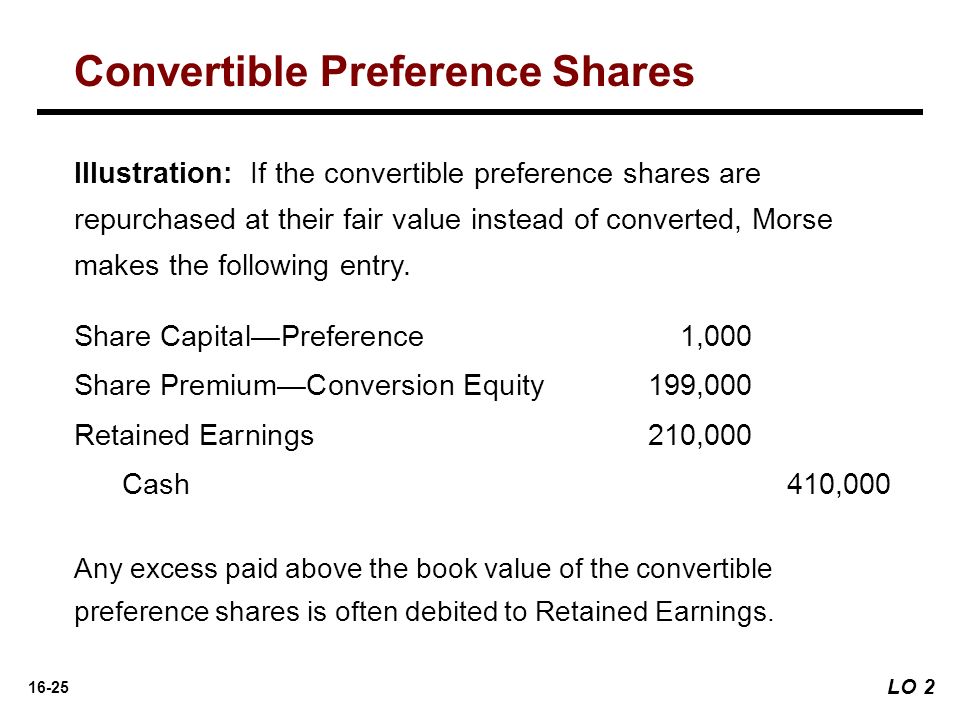

Accounting treatment for redeemable preference shares If preference shares are redeemable then shares are reported as liability in statement of financial position. Here shareholders are allowed to convert their preference shares into common equity shares. When you own equity share you become a part owner and are entitled to the companys profits and losses.

Holders of shares of the Series B Preferred Stock are entitled to receive cumulative cash dividends at the rate of 875 per annum of the 2500 per share liquidation preference equivalent to 21875 per annum per share. The following procedure is to be followed for Issue of Convertible Preference Shares on Preferential basis by a Company limited by Shares under Section 42 55 62 Rule No. Convertible preference shares are preference shares which are issued with.

9 10 13 of the Companies Share Capital and Debentures Rules 2014 and Rule No. Preference shares can be convertible or non-convertible. Preference shares are redeemable.

Preference Shares The shares which do not carry voting rights but the rate of dividend is fixed. This is an interesting fact that although they. Redeemable preference shares RPS are a type of preference shares that are issued on terms that they may be redeemed in the future at the companys option or subject to the terms of issue.

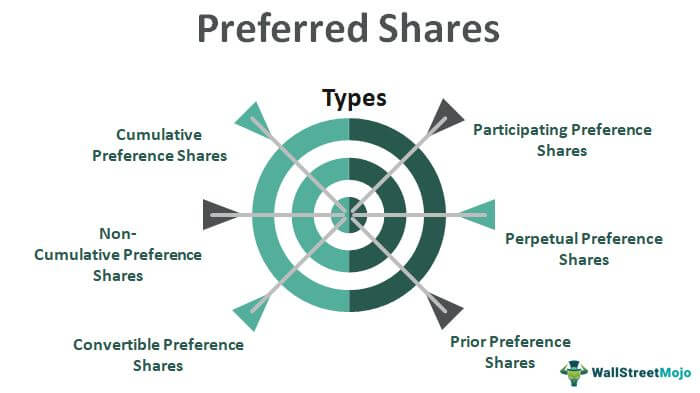

They are redeemable in nature. Such preference shares are non-redeemable but come with mandatory fixed dividends that are below market rate. There are various classes of preference shares including cumulative non-cumulative redeemable participating and convertible preference shares.

Cumulative preference shares With this class of share when a company is not able to pay guaranteed dividends due to insufficient profits in a particular financial year the dividend is accumulated. In case of redeemable preference shares the issuing company can purchase the preference shares back from the holder before maturity. In financial markets a share is a unit used as mutual funds limited partnerships and real estate investment trusts.

Preference shares are common in the financial world. These preference shares are also known as callable preferred stock and serve as one of the most effective ways to finance big companies. Equity shares cannot be converted into preference shares.

These types of. Regardless they enjoy the preferential benefit when it comes. There is no security charge created for payment of.

Share capital refers to all of the shares of an enterprise. Redeemable Preference Shares. Weighted-average shares used in calculating net loss income per share basic 134403059 31878762 134154171 31719005 Weighted-average shares used in calculating net loss income per share.

Shares cannot be converted as opposed to debentures are convertible. Foreign Investment inflow is an important reason for Indias economic growth. A series A round also known as series A financing or series A investment is the name typically given to a companys first significant round of venture capital financingThe name refers to the class of preferred stock sold to investors in exchange for their investment.

The owner of shares in the company is a shareholder or stockholder of the corporation. This is the standard kind of share that has no special restrictions or rights to itEach share offers equal rights to the shareholders of the company. In trading on Friday shares of AltaGas Ltds Cumulative Redeemable 5-Year Rate Reset Preferred Shares Series A TSX.

Equity shares represents ownership in a company. A share is an indivisible unit of capital expressing the ownership relationship between the company and the shareholder. These types of shares are sans any maturity date.

In the event of winding up of the company preference shares are repaid before equity shares. The Income Tax Appellate Tribunal ITAT has held that the claim of loss arising from investment in equity shares non-convertible debentures and zero coupon redeemable preference shares is not.

Types Of Preference Shares Youtube

7 3 Classification Of Preferred Stock

Redeemable Preferred Stock Youtube

What Does Rccps Mean Definition Of Rccps Rccps Stands For Redeemable Convertible Cumulative Preference Shares By Acronymsandslang Com

What Are The Different Types Of Preference Shares Tutor S Tips

Rcps Definition Redeemable Convertible Preference Shares Abbreviation Finder

Procedure For Redemption Of Redeemable Preference Shares Lawrbit

Chapter 16 Dilutive Securities Ppt Video Online Download

Convertible Preference Shares Meaning Advantages And More

Redeemable Preference Shares Examples Definition How It Works

Redeemable Preference Shares A Comprehensive Outlook

Redeemable Preferred Stock On The Balance Sheet Youtube

Rcps Redeemable Convertible Preference Shares

Preferred Shares Meaning Examples Top 6 Types

7 3 Classification Of Preferred Stock

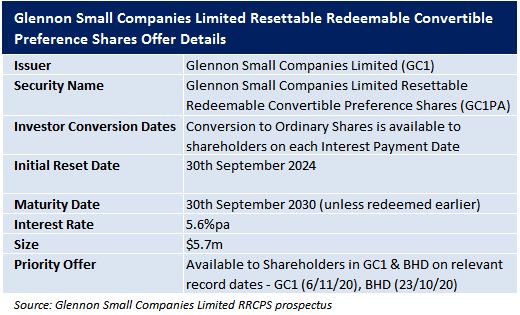

Glennon Capital Rrcps 5 6 Pa Funds Focus

What Is Preference Share Great Cfo

What Is The Abbreviation For Redeemable Convertible Preference Shares